Top-Up Health Insurance

This blog article will focus on Top-up Health Insurance & more specifically:

What it is

Example of normal local health insurance benefits & policy shortfalls

How top-up insurance works

Benefits & cost

Top-up Health Insurance

Noun

Private health insurance which covers you outside the scope of your employer provided health insurance, whether you exhaust your policy limits or for benefits that you don't have.

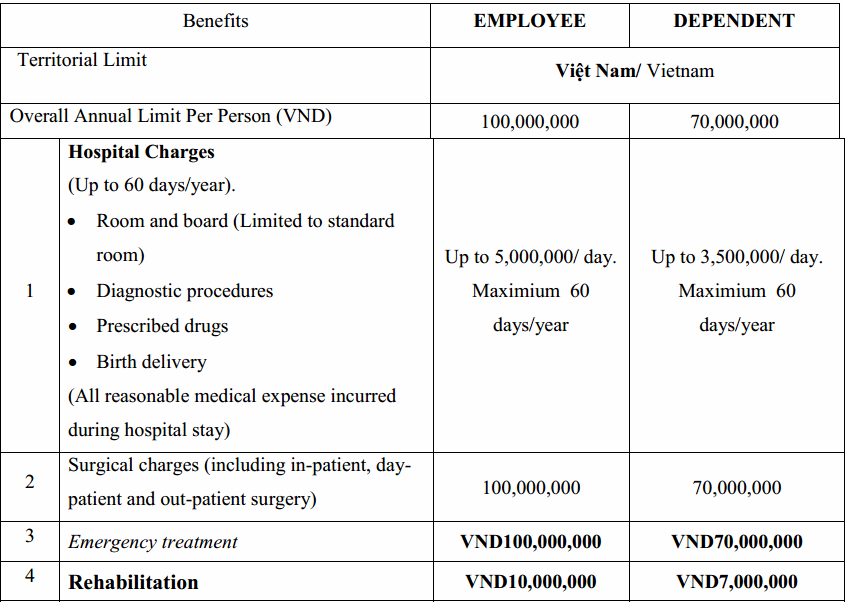

Normal Local Health Insurance

Many employers in Southeast Asia provide health insurance from local insurance companies that have a maximum annual limit between $3,000 - $10,000 USD/person/year. On top of that the coverage area is usually restricted to just the residence country, so for example:

Vietnam only

Thailand only

Cambodia only

Benefits:

Policy Analysis:

Maximum claimable for any one person is ~$4,300 usd- enough to cover very minor procedures only.

Vietnam only, zero coverage anywhere else which leaves you completely exposed if you're traveling for business, holiday or if the doctor/treatment you require is not available in Vietnam.

Room/Board + tests + medication + every other hospitalization expense are limited to 5,000,000 VND/day, which is very low.

It makes sense though, a local company purchasing insurance that fits their budget through a local provider, we cannot argue with that.

Q: What happens if I exhaust my limit? What happens if I need treatment while I was away for work or holiday? What if the doctors, equipment or facilities that I require are not available in my residence country and my only choice is to go abroad?

A: Unfortunately, that whole expense would be your responsibility- your provider will not cover it no matter how bad of a spot you're in. It's the plan your employer selected and paid for, that's all it covers.

This is where Top-up Health Insurance comes in.

Top-up Health Insurance

As mentioned, top-up health insurance kicks in where your plan work's health insurance plan falls short. You could also take a top-up plan if you are not offered benefits you want through your work insurance, such as Outpatient, Annual Health Checks, Dental or Maternity.

Usually with top-up insurance, you can take a deductible/excess which is approximately equivalent to your work insurances' annual limit. Then the private top-up plan kicks in after that.

For the example above taking a top-up plan with a $5,000 deductible would accomplish the following:

Cover you outside Vietnam

Cover you on top of the low annual

Discount of 50% by taking a $5,000 deductible, compared to the normal private health insurance rates

Protect yourself, your bank account & savings

Features, Benefits & Cost

Direct Billing Across Asia

Cashless direct billing at major international hospitals & clinics in Cambodia, China, Hong Kong, Indonesia, Japan, Laos, Malaysia, Myanmar, Philippines, Singapore and Vietnam.

Phone App

Find policy documents, direct billing & submit claims conveniently on your member's app.

Coverage Separate from your Employer

Own your policy to guarantee coverage, regardless of who your employer is. This lowers long-term risk.

Benefit Summary

= fully covered

= not covered

| Option 1 | Option 2 | |

| Coverage Area | Worldwide excl. USA | Worldwide excl. USA |

| Annual Limit | $1,000,000 USD | $1,000,000 USD |

| Inpatient Surgeries | ||

| Hospitalization Fees | ||

| Cancer | | |

| Emergency Room outpatient visits | | |

| Outpatient surgery | | |

| Annual Outpatient Limit | ||

| General Practitioner & Specialist's fees | | |

| Diagnostic and lab tests & medication | ||

| Physiotherapy | | |

| Chiropractor | $1,000 | |

| Annual Health Checks | $400 |

Annual Premium with $5,000 USD Deductible

| Option 1 | Option 2 | |

| Age 25 | $514 | $1,314 |

| Age 30 | $595 | $1,583 |

| Age 35 | $669 | $1,814 |

| Age 40 | $764 | $2,079 |

| Age 45 | $926 | $2,469 |

| Age 50 | $1,029 | $2,683 |

| Age 55 | $1,364 | $3,503 |

| Age 60 | $1,641 | $4,312 |