Model Portfolios

We have a portfolio available for every risk profile and the portfolios can be constructed within Managed Accounts, tax-advantaged 'wrapper' accounts, as well as trusts, pensions and corporate benefit plans.

Contact us to complete a risk tolerance questionnaire and find out which portfolio is right for you.

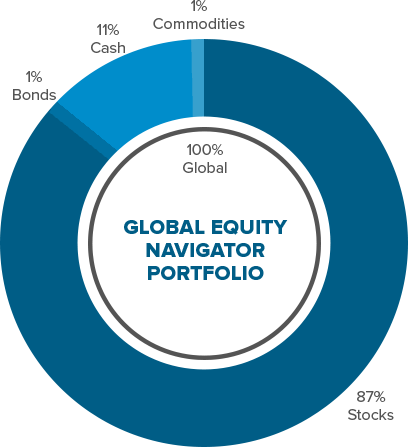

Global Equity Navigator Portfolio

[High Risk]

Annual returns per year since inception: 7.62%

Investment Strategy

Asset selection is conducted in accordance with a 3-step macro top-down process, which includes:

1) Idea generation from a universe of global assets

2) Macroeconomic evaluation of a given idea or theme, which includes development of a quantifiable conviction level

3) Relative valuation of shortlisted assets vs. peer group.

Technical analysis dictates timing decisions only. Assets are reviewed monthly and profits taken when an asset appreciates substantially over a short period. No more than 5% of the portfolio is invested in single direct equity. Portfolio will hold concentrated positions in a maximum of 20 assets. High conviction ideas are leveraged.

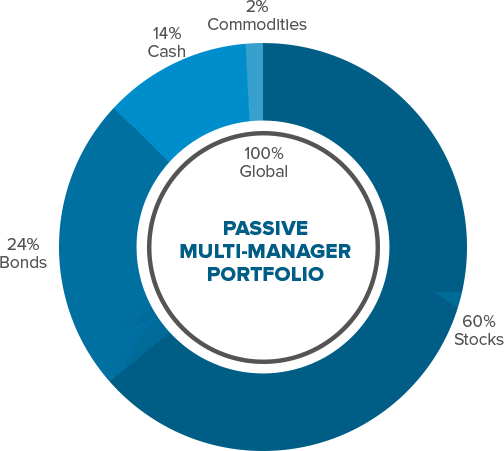

Passive Multi-Manager Portfolio

[Medium Risk]

Annual returns per year since inception:

11.04%

Investment Strategy

The portfolio allocates to mutual fund managers who rank superior relative to peers according to the following criteria:

1) Strategy and ability to generate risk-adjusted returns (IR)

2) Broad asset allocation mandate

3) Global investment universe

4) Favourable analyst rating (Morningstar research services)

5) Proven history of consistently beating benchmarks

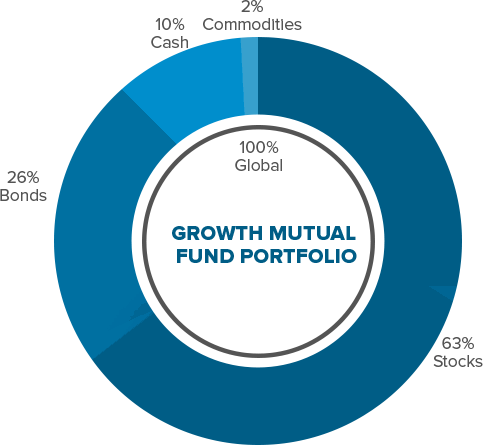

Growth Mutual Fund Portfolio

[Medium - High Risk]

Annual returns per year since inception: 4.86%

Investment Strategy

The portfolio is managed according to a tactical asset allocation process, which means that the firm's research team will evaluate global economic trends, such as inflation, corporate profits, unemployment, among many others, and select funds which are most likely to benefit from these trends.

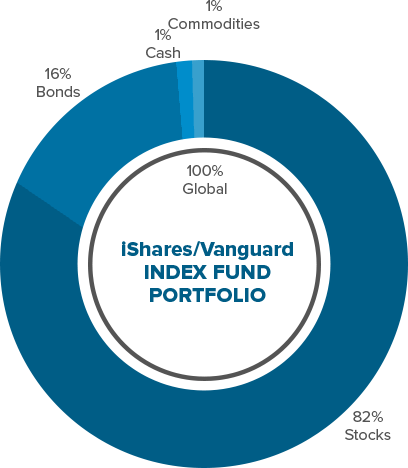

iShares/Vanguard Index Fund

[Moderate - Aggressive Risk]

Annual returns per year since inception: 5.2%

Investment Strategy

The portfolio uses index funds provided by the two largest asset management firms in the world, namely: Vanguard and Blackrock, who collectively manage in excess of 8 trillion US Dollars worth of assets. The portfolio uses an indexing approach to provide investors with a 70% allocation of global stocks and real estate, while 30% is allocated to global bonds.

It also seeks to balance all credit spectrums among most global regions, industries, asset classes as well as across all credit spectrums in order to provide an investor as much diversification as possible to limit downside risk.

Build your portfolio with Tenzing Pacific

Complete a risk tolerance questionnaire today.