How Tenzing Can Help You - A Case Study

Recently a client we’ll call David approached us to get quotes for insurance.

David had a suspicion that he was overpaying for his international insurance so he contacted Tenzing to see his options and if we could help him with cheap health insurance in Vietnam.

Here's what we did to make sure he got the best value for his money.

He had a good hospitalisation policy from a reputable provider & wanted something with comparable benefits & terms:

Fully covered hospitalisation & surgery expenses

Chronic conditions

Cancer (inpatient & outpatient)

Emergency Evacuation

Freedom of treatment to select any hospital he’d like for major treatments

To be clear, there was nothing wrong with his current provider & he did not have any issues other than the price. During the consultation, it was apparent that he had been oversold. Most likely this is because he bought insurance directly from the provider, rather than an unbiased 3rd party, such as Tenzing.

| Insurance buying tip: When you buy direct from an insurer you get offered what they have, not necessarily what’s best for you and at the best price. So unless you get quotes from many providers, it’s quite easy to be oversold. “You can get a comparable plan from our competitor for less money” said no insurer ever. |

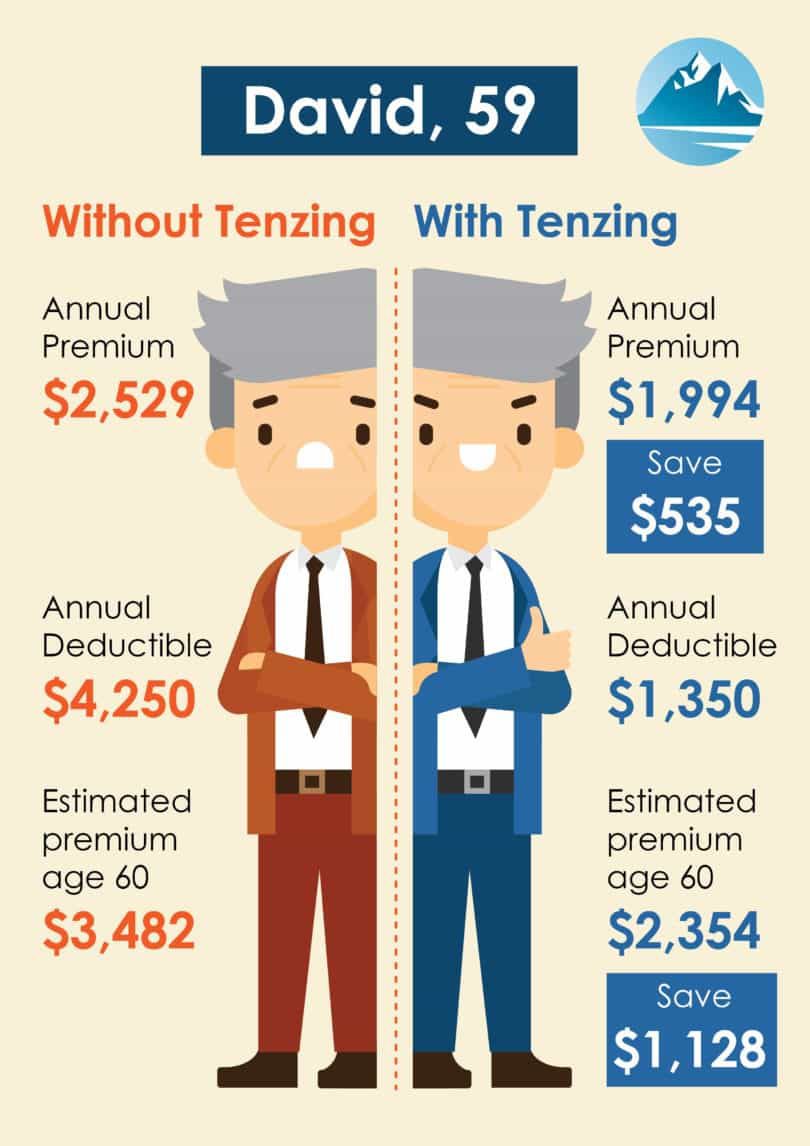

After being presented a side-by-side comparison of multiple plans, including his original one, David selected a new provider with comparable benefits & terms. This was, in fact, cheap health insurance in Vietnam, namely in three key areas:

1. Current Annual Premium

| Item | Before Tenzing | After Tenzing |

| Annual Premium, age 59 | 2,529 USD | 1,994 USD |

| Amount Saved | 535 USD |

So right off the bat, David saved $535 on this year’s premiums by switching providers. For a comparable plan, why is it that much cheaper you may ask? A major factor has to do with the coverage area.

Historically, most international insurers would offer Worldwide excluding the USA as the standard coverage area. There is a growing trend to offer SE Asia excluding Singapore as the standard coverage area. By doing this, you remove many expensive places for treatment such as Singapore, Hong Kong, Japan, Europe, etc.

2. Annual Deductibles

| Item | Before Tenzing | After Tenzing |

| Annual Deductible | 4,250 USD | 1,350 USD |

An annual deductible is an amount that you’re responsible for before the insurance kicks in. You may opt to take a deductible in order to save money on your annual premium. In David’s old plan he had a $4,250 annual deductible. With his new plan, that was lowered to $1,350.

To illustrate the potential savings, let’s see a couple of scenarios:

Scenario 1: $5,000 hospital bill

Before Tenzing, this would cost David $4,250 & the insurer would cover the remaining eligible expenses

After Tenzing, this would cost David $1,350 & the insurer would cover the remaining eligible expenses

A $2,900 savings

Scenario 2: $2,500 hospital bill

Before Tenzing David would pay $2,500 & still have $1,750 left on his annual deductible.

After Tenzing David would pay $1,350 & have $0 left on his annual deductible.

A $1,150 savings

Over time & as more expensive medical bills accumulate with age, there are substantial savings here.

3. Future Premiums

In addition to this year’s premium, you should also factor in future premiums from your provider. Each one increases their rates in different age bands & at different rates of increase. In this case, there was a substantial difference between the expected future premium at his renewal next year:

| Existing Provider | Recommended Provider | |

| Estimated Premium Age 60 | 3,482 USD | 2,354 USD |

| Estimated Savings Next Renewal | 1,128 USD |

Here’s David now:

We know David is happy with his reduced price health insurance in Vietnam. Be happy with your premium too.

For more tips on how to save money, please read our article about How to Save Money on your Health Insurance.

Get a Direct Comparison of Insurance Providers

Insurance Simplified