The Best Time to Get Insured

Is There a 'Best Time to Get Insured'?

If you’ve spent any amount of time living in SE Asia, you’ve probably known or remember someone who’s had a major medical issue without insurance.

It happens far too frequently and for a variety of reasons. We can guarantee you don’t want to be the one with a Go Fund Me page soliciting donations from your network or strangers.

Logically, one might guess the best time to get insured is prior to a major hospital visit. While that holds some merit, just because you’re insured doesn’t necessarily mean you’re covered.

Before we reveal the best time to get insured, we need to get to an elephant in the room for many expats living in SE Asia:

Home Country Bias

“I’ve never had private insurance before"

“I do not understand private health insurance"

“I do not believe in privatised health insurance"

Consider yourself lucky if you’re just now having worry about health insurance. However, you need to realise the rules from your home country do not apply here.

The sort of thinking from above is putting yourself, your family, friends and your bank account on the hook. The sooner you remove your personal feelings the better.

If you’re living in SE Asia, the fact of the matter is, private health insurance in SE Asia is not the NHS (or any other national healthcare system.

It does not cover you for everything regardless of the circumstances.

The point of the insurance for you is protecting you against future unknowns; the cost of treatments for conditions that originally occur after the start date of your policy.

The point of the insurance for the provider is to make money, not to cover you from everything. Hence why understanding pre-existing conditions is so important.

Pre-Existing Conditions

Usually right toward the top of the exclusion section of your policy wordings is the one for pre-existing conditions. This is one of the most important aspects of any policy and it will play a crucial role when you’re signing up. Whether that’s when you’re seeking coverage for the first time or you’re looking to change providers at renewal.

If you are needing a condition to be covered there are options. You’ll need to declare said conditions & have it/them accepted by the provider.

Every time you change providers or delay in getting insurance, you expose yourself to the risk of having pre-existing conditions excluded.

That’s Exactly Why The Best Time To Get Insured Is WHEN YOU'RE HEALTHY

You don’t have to worry about having claims denied or having special terms or exclusions added. Further to the point, after you’ve signed up you want to build a history with a provider. Don’t give them any reason to deny you coverage for an expensive treatment.

| Insurance buying tip: Ask your broker/agent how your provider handles renewal premiums following a high claims year. Cheap policies will undoubtedly have unfavourable renewals terms which can significantly cost you in the long-term, especially if you have a serious condition that you’re now trying to seek coverage for. |

Case Study

As we previously eluded to, even if you’re signed up you could still have a claim denied as a pre-existing condition. This can hold true even if you were not aware you had that condition at the time you applied

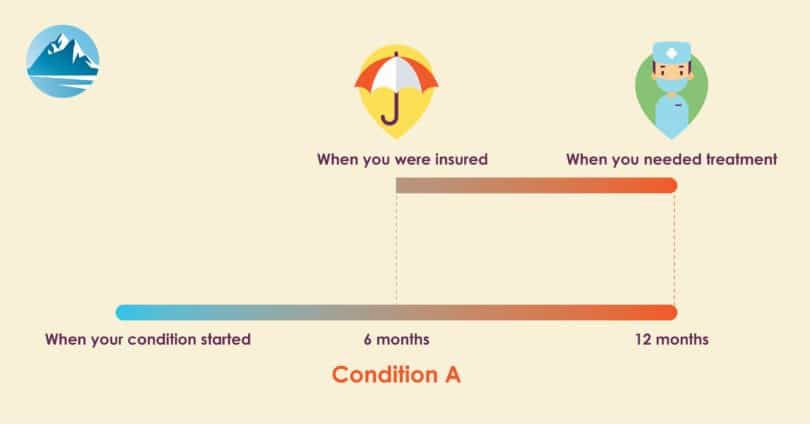

It just depends on the exact condition & how long you’ve been insured. Let’s see an example:

For example, let’s say you have Condition A:

Typically for Condition A, you may not need to have any sort of operation/treatment until a year after the onset of the condition. If you’ve only been insured for six months, then you are putting yourself at risk of having the claim denied

Even if you were not aware that you had Condition A when you applied, the provider could deny your claim, leaving you on the hook for the bill. This is exactly why it’s important to originally get insured while you’re healthy & then stay insured.

Whenever you’re bouncing around from provider-to-provider or you have gaps in your insurance, you’re exposing yourself to the risk of having claims being denied as a pre-existing condition

Doing your homework up front can save time, a headache & money in the future

Closing Thoughts

Based on our experience, if you’re truly looking to protect yourself, follow these simple steps

Get insured when you’re healthy

Do your homework on the provider before getting insured. Ask questions. Seek a consultation from a broker/agent.

After you find a suitable provider for your needs, stay with that provider. Don’t let a year with no claims let you think you’ve “wasted” that year’s premium

Following these 3 simple steps will best protect you & your family over the course of time.

Get a Direct Comparison of Insurance Providers

Insurance Simplified